EQUITY FINANCING TRANSACTION

RISE APARTMENTS - SAN FRANCISCO, CA

REvest, Inc. arranged the equity financing for a 175-unit apartment development project at 1699 Market Street in the Hayes Valley neighborhood of San Francisco, CA. The project is being built at the former Flax Art Store site near the confluence of Gough, Market and Valencia Streets. The project is being developed by Presidio Development Partners while equity financing has been provided by Encore Capital Management. Construction completion and leasing commencement are expected in Q4 2019.

EQUITY FINANCING TRANSACTION

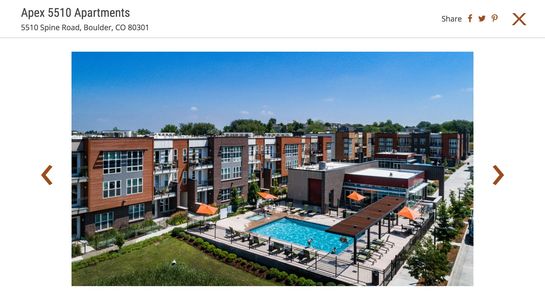

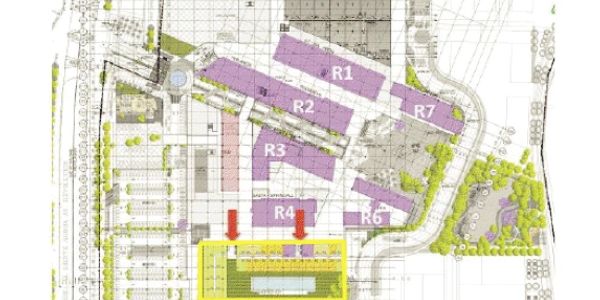

APEX 510 APARTMENTS - BOULDER, CO

REvest, Inc. arranged, on behalf of Crossbeam Concierge Residential Opportunity Fund, the LP Equity financing for the development of the Apex 510 in Boulder, Colorado. The $47 million project consists of 231 garden-style multifamily units located in the Gunbarrel Business Park with panoramic views of the front range of the Rocky Mountains. The financing was structured as a presale to a national life insurance company. Crossbeam developed the property utilizing Trammel Crow Residential Development Management Services.

SITE DISPOSITION transaction

29TH & TELEGRAPH SITE - OAKLAND, CA

REvest, Inc. represented Trammell Crow Residential in the sale of a 1.4 acre development site in the Pill Hill neighborhood of Oakland, CA. Located adjacent to the Alta Bates Summit Medical Center, the site was acquired by Scannell Properties of Indianapolis, IN who intended to develop a multi-tenant medical office building but decided otherwise. The site was subsequently sold to an apartment developer who has completed the project as originally approved and renamed it Town29 Apartments.

EQUITY FINANCING transaction

ELEVE APARTMENTS - GLENDALE, CA

REvest, Inc. collaborated with the Structured Finance Group of Studley, Inc. (Los Angeles, CA) on behalf of American Multifamily, Inc. (Huntington Beach, CA) to provide the LP equity financing for the land purchase and subsequent development of Eleve Apartments in Glendale, CA. The urban multifamily project consists of 25,000 square feet of retail space and 208 multifamily units, with an amenity package and downsized unit mix oriented toward young adults between the ages of 18 and 34. The equity for the project was provided by a BlackRock/CALSTRS multifamily fund. The project was constructed for $47.8M and sold for $72.0M three years after completion resulting in a project level un-levered IRR of 14.6%.

PROPERTY ACQUISITION AND EQUITY FINANCING transaction

415 PREMIER APARTMENTS - EVANSTON, IL

REvest, Inc. arranged and closed the purchase of the first mortgage note and subsequent deed in lieu of foreclosure on a 17-story apartment tower in Evanston, Illinois. Crossbeam Capital acquired the note on the then Skyline at Evanston Apartments from PNC Bank and immediately thereafter received the deed in lieu of foreclosure from the borrower. This marked REvest, Inc.'s first transaction stemming from its working relationship with Crossbeam Capital, an institutional real estate investment management firm providing equity capital for development and acquisition of multifamily properties.

OPERATIONS CONSULTING ASSIGNMENT

NUEVO SUR APARTMENTS - MONTERREY, MEXICO

REvest, Inc. provided multifamily operations consulting services on a subcontract basis to a multifamily developer charged with advising a pension fund advisor on multifamily development in Mexico. The assignment focused on the marketing, management, administration and expenses associated with apartment projects in Monterrey and Mexico City that would be 100% rental as opposed to fragmented rentals in condominium projects which had been commonplace.

SITE DISPOSITION CONSULTING ASSIGNMENT

NAPA CREEK APARTMENTS - NAPA, CA

REvest, Inc. provided disposition consulting services to Thompson/Dorfman & Trammell Crow Residential on a development site entitled for 48 residential units. The owner had planned to build apartments but decided to sell to property to potential condominium developers. The assignment focused on completing the entitlement process, obtaining market studies, preparing the investment package and selecting a broker to market the property.

Copyright © 2019 REvest, Inc. - All Rights Reserved.